By Francis Kobena Tandoh

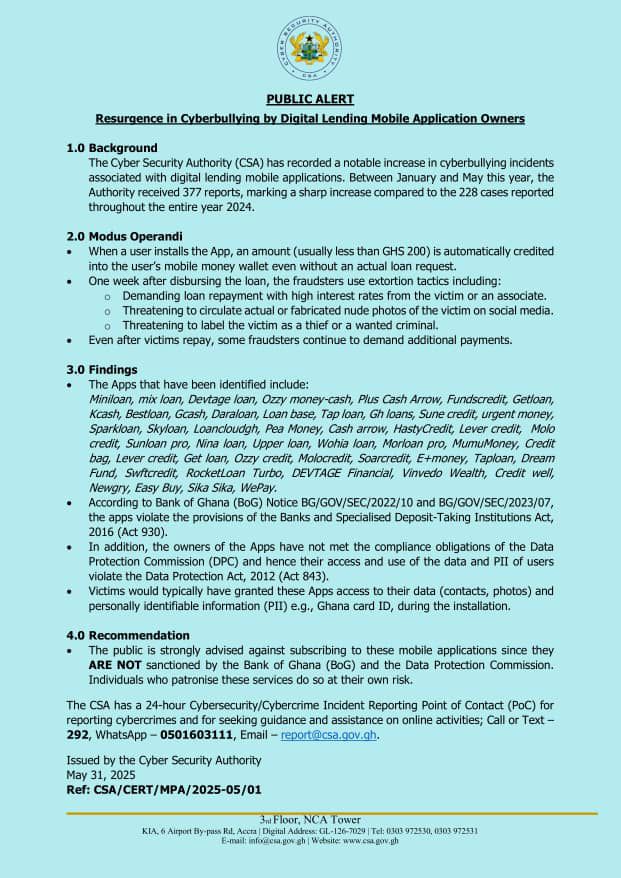

The Cyber Security Authority (CSA) has cautioned the public against subscribing to some unauthorised digital mobile applications in the country, according to a statement released here.

According to the CSA, the operators have devised crafty ways of luring their unsuspecting clients to get unto their system after which they take undue advantage of them.

The perpetrators, the CSA notes often demand high interest rates, threaten to circulate actual or fabricated nude photos of victims, or threaten to label them as criminals.

“The Cyber Security Agency has recorded notable increase in cyberbullying incidents associated with digital lending mobile applications. The public is strongly advised against subscribing to these applications since they are not sanctioned by the Bank of Ghana (BoG) and the Data Protection Commission,” said the CSA.

“Individuals who patronise these services do so at their own risk,” added the Cyber Security Authority.

Among the apps identified by the CSA to be engaged in cyberbullying include Miniloan, Devtage Loan, mix loan, ozzy money-cash, Plus Cash Arrow, Cash Arrow, FundsCredit, Lever Credit, Getloan and Upper Loan, Kcash, Bestloan, Gcash, DaraLoan, Loanbase, Taploan, Gh Loans, Sune Loans, Urgent money, Sparkloan, Skyloan, Loancloudgh, and Pea money among others.

“These apps operate without legal backing and often disregard consumer protection laws. Engaging with them exposes users to serious risks, including data breaches, harassment, and financial loss,” the CSA cautioned in a statement.

The Authority urged Ghanaians to verify the legitimacy of digital lending platforms before use and report suspicious activity through its 24-hour cyber incident response system. Enditem

Source: Ghana Eye Report

Find the statement from the Cyber Security Authority (CSA) below: